Bitcoin leverage trading Philippines

What is bitcoin leverage trading?

In stock trading, margin trading or so-called leveraged trading is widespread. In essence, this type of trading is considered speculative. Margin is a certain amount of collateral against which you can obtain funds that are sometimes even a hundred times larger than the collateral. This difference of a margin loan from usual one considerably increases opportunities for a trader at the stock exchange, allowing you to operate with considerable sums of money with actually small initial installment. The Philippines is a country, which population is known worldwide for its love of gambling, and its economy is closely linked to the world leader in trading, the USA, so it is not surprising that this country is not left aside and Bitcoin margin trading in Philippines is becoming more and more popular. On a monthly, daily, hourly basis, more and more Filipinos are looking at bitcoin as an interesting alternative for their investments, and their inherent risk-taking courage is allowing them to reach the top of the trading field.

In this short article we will take a look at how leveraged bitcoin trading works, where to start and what are the main things to look out for if you decide to try your hand at this new direction for you so far.

How does bitcoin margin trading work?

When using leverage, the trading platform offers you two types of positions, long-term and short-term. Long-term positions are those that involve an increase in the price of an asset while short-term positions are those in which the trader believes that the price of the asset will decline.

If it turns out that the trader's predictions were correct and the trader makes a profit, the profit is directly proportional to the amount of leverage. Thus, the broker will get back the full amount of credit (the credit body), as well as the reward amount (commission, if it was stipulated in the contract). The balance of the operation will be credited to the trader's account, which will be his profit.

How to trade bitcoin with leverage online

By choosing bitcoin as an investment, the trader has the opportunity to take advantage of leverage by trading on price variation (price decrease or increase) through CFDs or contracts for difference. The trader predicts at his own risk the fluctuation of the price and bets on its increase or decrease, receiving in this case the profit is directly proportional to the rate - provided, of course, that the price prediction will be correct.

The leverage can vary from as little as 10 times (1:10) to as much as 1000 times the stake (1:1000). How does it work? Suppose you are willing to invest only $100, while a broker can offer you a multiplier of x10, then the amount of your transaction will correspondingly increase by a factor of 10, that is, it will be $1,000. Thus, even if the price rises by only 1%, you will make a profit of $100, and without the leverage the amount of your profit would only be $10. However, trading with leverage is both tempting and very risky because the same price swing, but downwards, can cause significant losses. You should bear this in mind when you are just starting out in investing and have no experience in this kind of trading. To get started, experts advise applying a minimum multiplier, as well as taking the training offered by the trading platform.

Bitcoin leverage trading platform

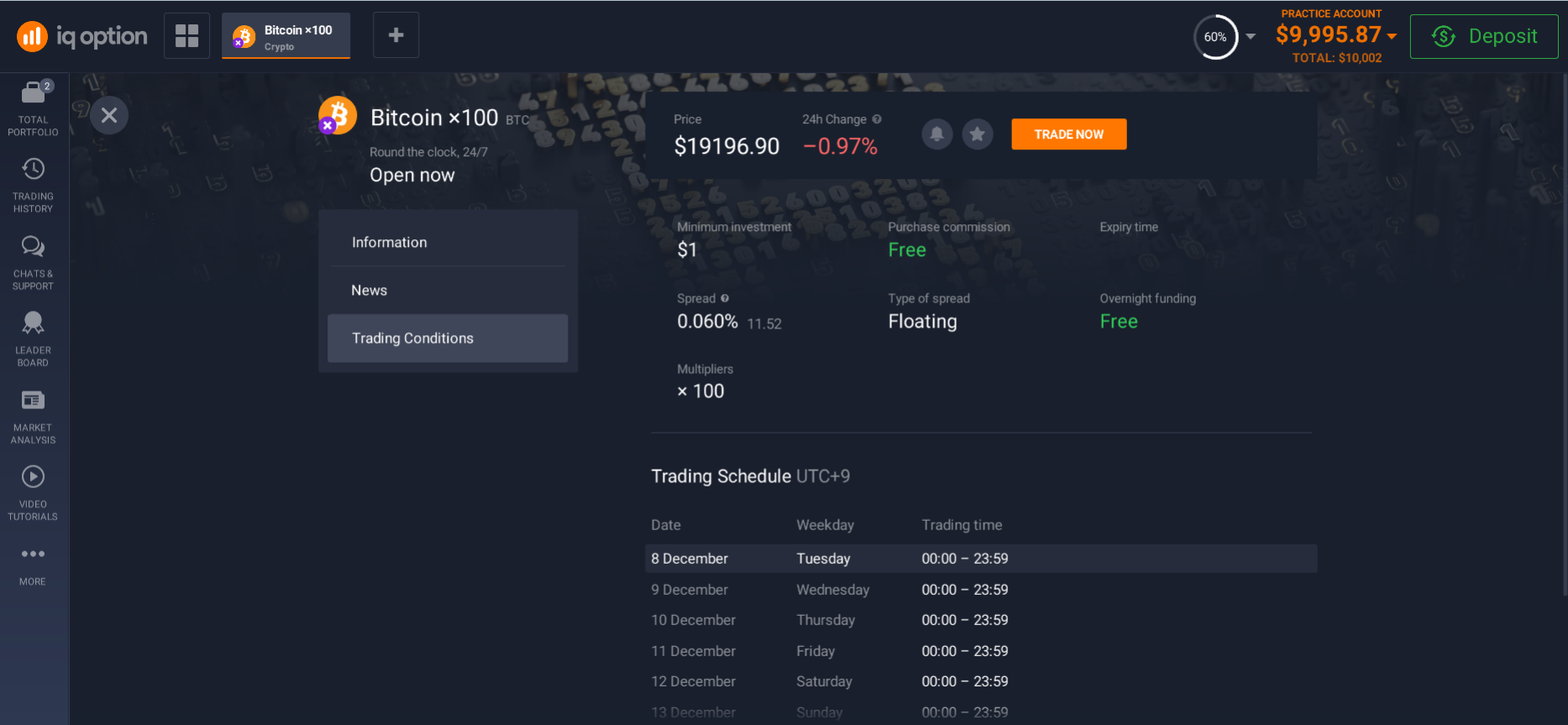

Most brokerage companies now offer their clients the use of leverage for bitcoin trading. The IQ Option trading platform features a particularly user-friendly user interface and offers CFDs on all popular digital currencies, including bitcoin. Investing is easy - you simply deposit a certain amount on your deposit and purchase a cryptocurrency CFD, using the leverage option if necessary.

Brokers offer different multiplier sizes for different cryptocurrencies.

How to start bitcoin trading with leverage

What do I need to do in order to start trading bitcoins in the Philippines?

We recommend the following sequence of steps:

1. Get training. Since trading involves certain risks and possible financial losses, be as theoretically prepared as possible to understand how leveraged bitcoin trading works. Trading platforms will usually offer their users complete training sections, which include access to theoretical material and video examples. Don't neglect the training and don't trade blindly, a thorough approach to trading is most likely to yield good results.

2. Choose a trading platform. It is worth reading the reviews of the platform. Also, consider what kind of trading tools and types of cryptocurrencies this platform offers, the minimum deposit size and so on.

3. note that each platform charges a percentage for certain services provided - read the service price list in detail.

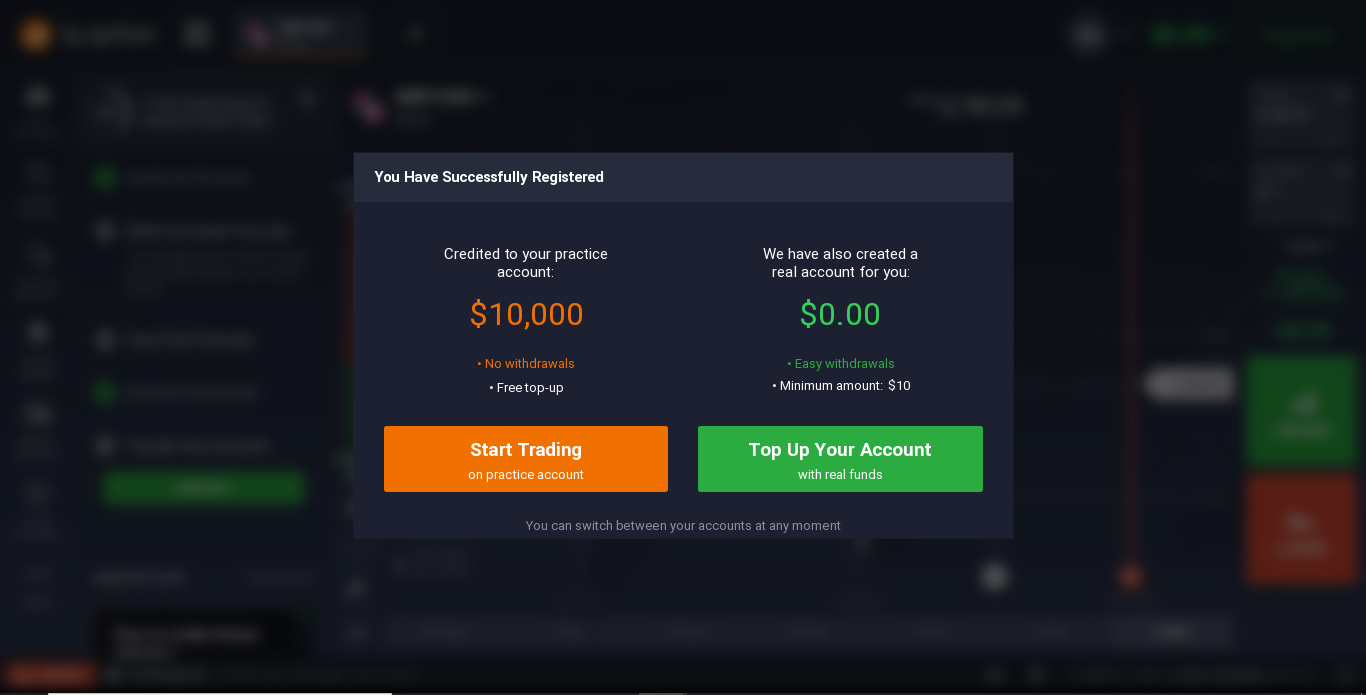

4. open an account on the platform. The IQ Option platform, as well as many other platforms, offers to open a demo account for a start. A Demo Account is a training account, the amount of the account is set at $10,000 and can be reinstated as many times as you need to learn. When you feel ready to trade for real, open a real account - the procedure to open a real account takes minimal time and requires you to make a deposit. The platform offers many easy and affordable deposit options, which we will discuss below.

5. When you first start trading, invest the minimum amount you can afford to lose. Until you have had enough experience in trading we recommend you use the minimum amount of leverage, for example x2 or x3. In case of a trade failure, your loss will not be too big.

In addition to a large array of user-friendly tools, the IQ Option trading platform also offers a mobile app that allows users to trade non-stop in real time, providing comfort and ease of use.

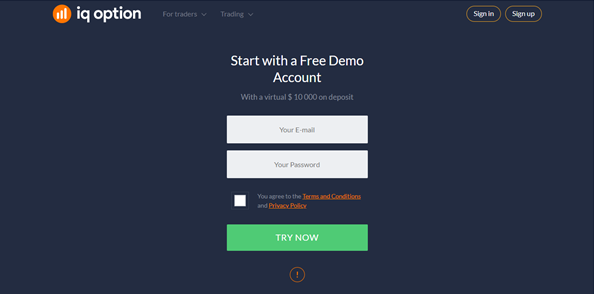

How to register

Registering on the platform is no more complicated than registering on a normal social network - you need to enter your details, such as your email and name, and come up with a password. However, since this is not a social network for fun and we are talking about money transactions, be prepared to go through additional verification by providing scanned copies of your identity documents. This verification is necessary to be able to withdraw funds from the trading platform in the future.

How to open a demo account

By the time you have no experience in online trading, we suggest that you take advantage of a demo account.

On the IQ Option platform, opening a demo account is extremely easy - as soon as you register on the platform, you will see a pop-up window inviting you to open a demo or live account. By clicking on the "open demo account" button, you will immediately be able to open a demo account with an amount of $10,000. With a demo account you can carry out the same operations as you would do with a real account, without the risk of losing money. However, you will not be able to withdraw it either, in case of a successful transaction.

How to open a real account

Opening a real account does not take any longer than opening a demo account. By opening a real account you start trading with real funds (bitcoins) and have the chance to make real gains or suffer real losses. That is why, as said before, you should start trading with a small amount and use the lowest leverage ratio possible to minimize your exposure.

In order to open a real account, you are forced to deposit a deposit amount into your account.

How to fund a deposit

You can take advantage of various options for funding your deposit. The system offers both the use of a card and other payment systems, which are widely used in modern life. It is true that when paying by card, the amount is credited almost instantly, whereas transfers via other systems can take up to several working days.

Minimum deposit amount

The IQ Option platform is loyal to its users also in terms of quite democratic start-up amount - you can start your way into trading with a minimum investment of just $10. Of course, this is a great advantage of the platform, as it gives an opportunity to start even those who have a rather limited budget.No doubht, IQ Option is one of the best bitcoin leverage trading platform.

How to withdraw money

As mentioned above, you must be a verified user on the platform in order to withdraw your funds in case of a successful transaction. To do so, you must go through a simple verification procedure (provide scanned copies of your identification documents).

Safety of online bitcoin leverage trading

Bitcoin margin trading is a fairly complex process, but at the same time it is interesting and can be the start of your successful career as a trader. It is worth remembering that, without much experience, you should not start trading with large sums and also use the maximum amount of multiplier. At the same time you should not avoid using leverage either, you just need to choose the minimum amount you can borrow. If you act deliberately and slowly, gradually building up your own methods and studying the market, you can achieve good results.

How safe is it to trade online

Online trading platforms use advanced systems to protect your data to ensure the security of your transactions on the trading floor. Especially advanced platforms often have more than one security system as well, making it virtually impossible for a third party to attack the site.

Perhaps the main risk of losing money is in the trading itself - the methods, the sensible approach to investing and the experience. The risk of losing an investment is always present, so this point should always be kept in mind when choosing a leverage size. A good tool for minimising losses is a stop loss.

At the same time, leveraged bitcoin trading has its advantages, including the ease of borrowing, lack of special requirements or procedures, and the ability to use not only currency but also securities as collateral. Another advantage is that there is no additional fee for the loan itself.

My online trading is protected

There are companies that offer assistance against negative balances (in case of leveraged operations that generate significant losses in a very short time). Remember that you are the guarantor of the result in each position, analyze every detail and information that is relevant, besides practicing enough before entering real money. Experience, knowledge of the market and an adequate plan, will allow you to advance in a sector as complex as finance.